We are keen to receive review comments for our new paper which is now available for open peer review (pdf)

Kathryn Porter: Interconnectors and their impact on the GB power market

The GB electricity market has become increasingly reliant on interconnection with other European markets. Interconnectors are seen as key to managing periods of low wind output in an electricity system increasingly dependent on intermittent renewable generation. But what if the markets at the other end of those interconnectors are also experiencing dunkelflaute conditions? As most of them (with the exception of Norway) share similar weather to the UK, and (with the exceptions of Norway and France) share similar wind-led de-carbonisation strategies, can we really rely on interconnectors to ensure security of supply? And what about the effects of energy

nationalism which has been increasing since the war in Ukraine? Can we rely on countries being willing to export at all times when GB needs to import?

Submitted comments and contributions will be subject to a moderation process and will be published, provided they are substantive and not abusive. (Closed open reviews of GWPF publications can be found here).

Review comments should be emailed to: benny.peiser@thegwpf.org

The deadline for review comments is 13 May 2024.

—————

Duncan Wilson

Three aspects of interconnectors that you may wish to consider including:

* Their significant capital costs (and how credible is the cost benefit analysis that is currently undertaken);

* Transmission losses associated with the operation of interconnectors; and

* Technical faults on submarine cables and the long repair times and material costs that are involved.

————–

Dr John Carr

System Stress and compensating wind fluctuations

The paper focuses on the way interconnectors can deal with stress in the GB electricity supply, but concludes “ So far, there has not been a system stress event, triggering delivery under Capacity Market rules, but each year the risk of this increases. However, the performance of interconnectors in such an event is described by experts as entirely hypothetical.” Given the vital importance of avoiding blackouts it would seem the paper should go into detail about what the grid systems actually do protect GB against power cuts. This would require a discussion of what events are most likely to cause system stress e.g. sudden power station failures and rapid wind power fluctuations. A vital parameter must be the reaction time for the backup system to kick in. It is far from obvious that the supply fromseveral different interconnect cables from diverse countries could be coordinated to react fast enough. If this is part of the GB plan then a detailed discussion of how it would work is necessary.

The paper refers to the “Capacity Market” but does not give any numerical details which seem necessary to be able understand. The table listing the existing cables has a column “de-rating factor” which seems to be an important parameter but is not clearly defined and should be. In practice many of the interconnect cables run at 100% nameplate capacity despite a statement in the paper: “The de-rating factors determined by the Government in 2023 suggest that two thirds of available interconnector capacity would be available in a time of system stress.”

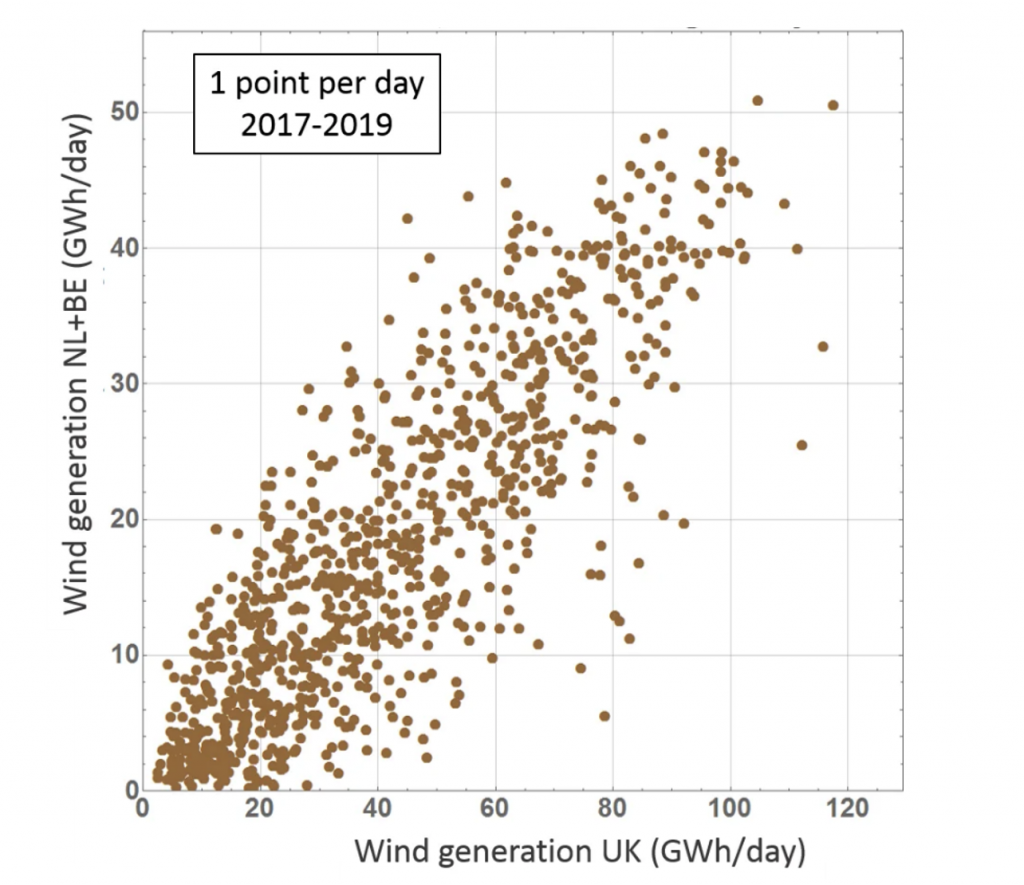

The paper mentions that with increasing dependence on wind power, a major source of possible system stress is low wind. The paper also states that there are correlations between wind generation in the UK and the countries linked via the interconnect cables. The paper gives some numbers for this, but the presentation is not very clear. Data plots such as the one below might help the reader to understand. ( More examples at Long Distance Correlations in Wind Power ).

Magnitude of Imports/Exports to the UK

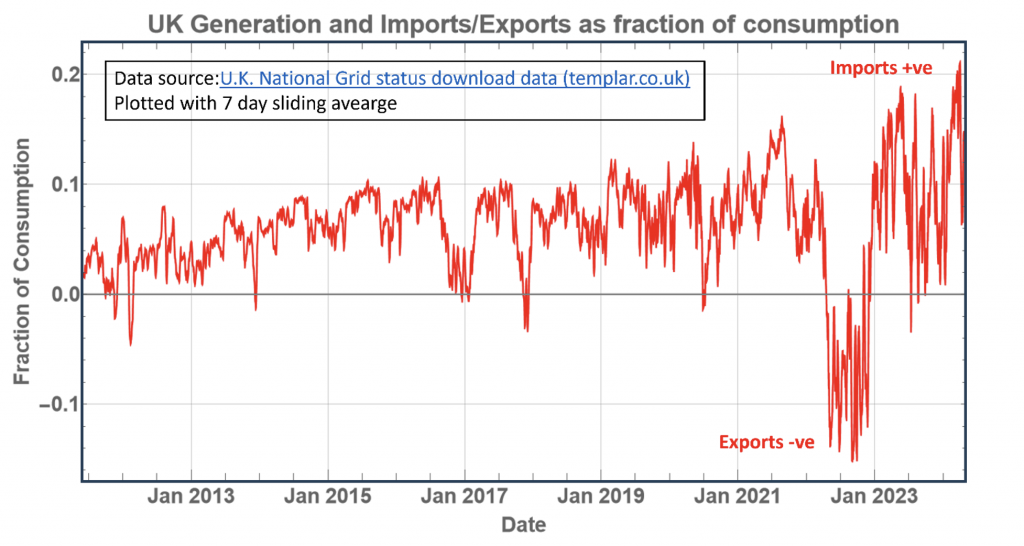

The paper does not properly indicate the magnitude of the imports to the UK and a figure indicating the amounts of imports/exports, such as the one below, seems essential. The paper says: ”The benefits of interconnectors may well be overstated. During 2022-23, imports only met 4.3% of Britain’s electricity demand, similar to the contribution of solar power (4.4%), which is only available during daylight hours and not at all during periods of peak winter demand.” From the figure below it can be seen that the year 2022 was very anomalous with significant exports from the UK. The cause of this was the reduction in nuclear output in France due to repairs for stress corrosion in cooling pipes, which is mentioned in the paper. For the paper to make a general conclusion based on this particular period is misleading. The average UK imports rose from around 5% in 2011 to nearly 15% in 2021. In April 2024 the weekly average imports exceeded 20%.

The paper ought to consider the current situation, where with the newest Norway and Denmark connections the UK daily average imports have in early 2024 sometimes exceeded 7 GW, around 25% of consumption. This indicates the UK is becoming increasingly dependenton the interconnections for normal supply. The paper ought to address in detail why this is.

The paper states: “These interconnectors currently have a total capacity of 8.4 GW and more are being built, potentially adding 16 GW by 2035.” This would give the UK the possibility 24.4 GW of imports which approaches 100% of the current average summer consumption! The paper ought to give the timescales of the cables under construction and details of those in planning. If really the UK plan is to import the majority of its electricity, the paper should explore this dramatic fact.

Financial Gain

Without the motivation for the interconnect cables to avoid blackouts, the reason for the interconnect cables must be financial. The paper does not cover this is any detail at all and this is a major omission. It would be very interesting to give the investment costs of the cables as well as the maintenance costs. What are the charges for transmission? What are the losses in transmission in the undersea cables and then in the land connections to the consumption sites?

An analysis of the cost benefits to the UK consumers from the interconnects seems essentialfor the paper. Is it economically better to build more interconnect cables than build local power plants? How will the recent changes in the EU Electricity Market change all this?

————–

Ken Hazell

I can see what the problem is and what risks there may be. To ensure continuity of supply in the UK, our only solution at present is to ensure there are sufficient reserves of gas and sufficient gas-powered generation plants.

—————-

Simon Clanmorris

Kathyn Porter’s paper is excellent and I could not find any typos apart from this one: 4 lines from the end on page 5 ‘form‘ should be ‘from‘ .

However I do have a major problem with this statement para 3 on Page 5

The benefits of interconnectors may well be overstated. During 2022-23, imports only met 4.3% of Britain’s electricity demand

I do indeed think that the benefits are overstated. (Indeed I would go further and say that we should not be a net importer. The targeting of Ukraine power infrastructure and the sabotage of Nordstrom 2 should be a warning about too much reliance on undersea cables. Kathryn mentions this in the penultimate paragraph of the Executive Summary)

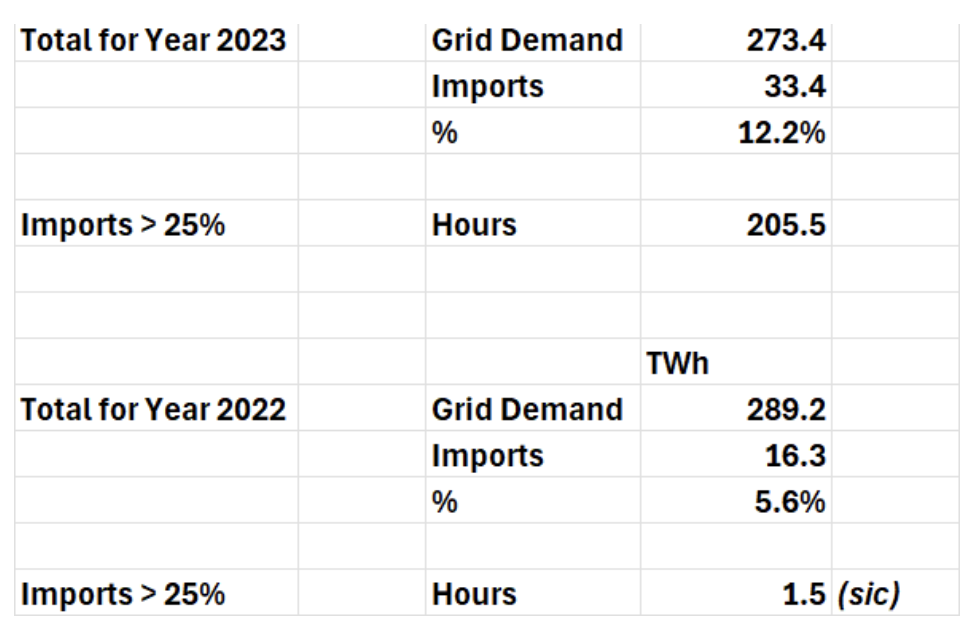

My problem is with the figure of 4.3%. Firstly the ESO figures for imports in 2022 were 5.6% not 4.3%. More importantly there was a major rebound in 2023 and imports were 12.2%. The figures are set out below. I have not analysed the reason for the major increase in imports in 2023. It could be due to the fact that in 2022 France had problems with nuclear reactors and Norway did not export much because its hydro power still was suffering from lack of water in 2021. Whatever the cause I think that 4.3% imports is not representative. As a matter of interest imports for the period January to March 2024 averaged 15.3%

————-

UK academic

Dunkelflaute – weather systems cover huge areas and high pressures with little or no wind and plenty of cloud cover can potentially cover the whole of the UK and surrounding continental countries. Some high pressure systems can cover most of Europe and last for weeks. This is particularly prevalent in winter when consumers need heating and lighting. The generation of energy from wind and solar will be almost nothing under these conditions.

I have seen reports where on average wind energy is only generated 29% of the time and solar energy can only generate electricity during the day. Therefore, backup generators (e.g. gas turbines, nuclear, coal etc) are essential to maintain the stability of the electrical grid system. This is called spinning reserve and can be switched in quickly to compensate for sudden drops in frequency and voltage. However, the more wind and solar that is incorporated onto the grid then the greater the need for back-up to be quickly switched in. All of these changes require management and at some point there will be a mismatch between supply and demand resulting in blackouts. Relying on interconnectors seems like a very risky strategy if, as outlined in the report, they can be switched off by suppliers.

I note from reference 19 in the report that one might draw the conclusion that the West is already at energy war with China. This and the gas pipeline damage in the Baltic places greater emphasis on energy security in the UK and Europe than is currently understood by governments. What are the implications for security and safety of UK citizens given the political ideology that CO2 emissions are bad (they are not) and renewables is the only way to save the world (they are not)?

Given that the author is a consultant presumably used to giving advice one would expect some recommendations to be made which would improve energy policy, safety, and security of the UK.

I agree in large part with the analysis in this report and the conclusions make sense.

At some point the UK energy system will breakdown. Alternatively, we need to make an informed choice as to what to do before we (or our politicians) are forced into a decision.

The UK is heavily dependent upon energy for heating, lighting and the functioning of businesses which rely heavily on computers and information technology. A power outage could be very damaging. With more renewables on the system and the potential for no interconnector supply a power outage is more likely, will be very damaging and will be hard to recover from. This is the result of governments choosing renewables as the favoured method of generation and electricity as the favoured use of energy for domestic and business consumers.

I would like to see a set of recommendations about what can be done to make the UK energy supply more reliable and less dependent on interconnectors. What would be the best way forward?

A military mind might approach the entire problem in a much more pragmatic way than any government. Perhaps that is what is needed.

—————

Ron Hughes

A word-search of Katheryn’s paper includes just a single reference to dispatchability and its importance in managing dunkelflaute periods – in the Executive summary:

“To manage dunkelflaute2 periods, dispatchable thermal power plants (gas and/or hydrogen), depending on the scenario and year, are likely to be required. A combination of LDES (e.g. Compressed Air Energy Storage (CAES), Liquid Air Energy Storage (LAES), Pumped Hydro Storage (PHS)) and interconnectors will be required to manage the network during these periods.”

That is one reference more than Nat Grid itself makes to dispatchability in its Apr 2024 “The power of partnerships.”

As a consequence of noting Nat Grid’s omission regarding the dispatchability status of interconnectors, yesterday morning I contacted NatGridESO for clarification.

To its credit, NatGridESO provided its response a short while ago:

“Interconnectors are generally non-dispatchable, however we do have arrangements that we can deploy if we need them to be dispatchable in the event of a major crisis.”

Consequently, I’d suggest that the dispatchability status of interconnectors is explicitly mentioned in “Interconnectors and their impact on the GB power market” because National Grid ESO confirms Interconnectors cannot be depended upon to deliver dispatchable electricity.

————–

Derek Birkett

This draft paper is very much overdue with most of the continental connections arising since I gave my presentation to the Global Warming Policy Foundation four years ago. Since 2013 when Ofgem gave formal notice of insufficient generating capacity to meet peak system winter demands, virtually all coal based generation has gone with remaining AGR nuclear capacity that will all disappear by the end of this decade. In addition gas turbine capacity has not been replenished from the ageing portfolio and only very recently has recognition for new capacity been recognised by government although I am not aware of how much capacity has been announced. Andrea Ledsome as Energy Secretary had attempted to do this but was demoted to the House of Lords for her decision. Interconnection capacity has been treated since as being part of available capacity in the winter and summer outlook reports from National Grid. The main offsetting advantage has been reduction of peak demands through cost from a peak of 60GW at 2010 to the present figure of 45GW. As the paper indicates security of supply with interconnection is a very real and pressing issue.

I regularly view the electricity map and have noticed French imports often conflicts with Dutch and Belgian exports having excessive circular transmission losses. From my past experience, line losses were never considered in an operational time scale. Calculation of consumer demand is a zero sum figure that would involve line (and transformer) losses so just how this distinction can be separated is unclear and can only be evaluated from design estimates. From memory line losses overall are as a percentage figure in the teens of total demand. Another factor is that losses are a function with the square of the current, in other words doubling the current gives four times the losses. With increasing wind investment from distant sources, the pattern of loading and losses across the system are bound to increase as does transmission investment for connection. In Scotland the disparity between supply and demand is set to become absurd. A related issue is security of supply from a single technology resource where the Great Storm of November 1703 has been forgotten. The force on any structure has a cubic function with wind speed where doubling wind speed creates a force of eight times.

Another security issue with interconnection relates to system inertia where no contribution is made for stiffening the grid against instability of protection performance. Historically with thermal generation this had never been a problem but the onset of most renewable technologies to include wind and solar also deny this crucial support. Hydro based technology with pumped storage and tidal basin exploitation are a solution that so far have been discarded. At times I have observed very low levels of support from nuclear and gas turbine technologies that are both steadily declining in availability.

——————-

Peter M. Wargent

Simplistically, energy is no different to any other commodity that is available and/or traded on world markets. It is rational that a country that has an easily or naturally available commodity exchanges/sells it with/too a country that lacks said commodity. This is the general basis for all world trade, and has generally benefited most countries for centuries (even the slave ‘trade’ ?!).

However, the laws of cussedness (for want of a better word) dictate that there will be hiccups, sometimes major, when a traded commodity is not easily available, for a variety of different reasons. The latter include natural ones such as variations in average/normal seasons, unforeseen events, either natural or man made; the latter including geo-political arguments and/or wars, etc..

But of all commodities energy is one of the most basic (as well as water). A society may run out of any food or material but more often than not be able to substitute a workable alternative, at least for a short period. Particularly in the 21st century, energy is different, and there is a palpable ignorance (certainly in Australia) of the amount of energy required to run a modern society (which even the most impoverished third world country aspires to). It is becoming increasingly obvious that for all the above reasons, and those mentioned/argued in Katheryn Porter’s Inter-connector paper, that energy (and water) occupies a special and non-negotiable place in a society’s ability to survive. Thus, regarding energy, whilst a country might enter various arrangements with others, it should always be mindful that, one way or another, it can act to ensure its own energy requirements are as self contained as possible.

—————

Dr John Cullen

1. My background is in electrical machines rather than electrical networks and thus my comments are made from that perspective.

2. Add words to ensure that importer and exporter are always easily distinguishable. For example, on page 1, “… and export when UK demand is high and imports would be preferable.” and “… which may reduce the availability of their exports to the UK.” Also add/move words for clarity, “… high weather correlation and with many countries in northern Europe relying on wind power, that means that …”

3. Page 2. Add words to “distribution and supply to houses and businesses” for consistency with diagram.

4. Page 2. “Most transmission lines are high-voltage three-phase alternating current (“AC”), however over very long distances, line losses can be significant.” Ref. 1 suggests that the reason for choosing HVDC is because of the lower cost of the DC transmission towers, DC insulators and DC conductors when costed over long distances, which off-sets the higher cost of the AC/DC converter stations compared to AC transformer substations.

5. Page 4. “Britain exported electricity to Continental Europe during 13% of the hours with the top 5% of demand during Winter 2020” Is that ‘top demand’in the UK or in Europe?

6. Page 4. “… while exports accounted for 16% of all hours over that period.” Ambiguity here: “that period” refers to what? The whole of winter 2020?

7. Page 5. Insert, as per comment 2 above, ‘UK’ into “This means that the high levels of UK exports …”

8. Page 5. “… in 13% of hours wind was low in all countries (which is equivalent to just under one day per week)”. This, in the absence of adequate electrical storage, illustrates the huge inadequacy of wind unless there is (i) huge overbuild of wind turbines, or (ii) ultra-reliable interconnectors.

9. Page 5. This page in particular is data rich and thus would benefit from also being displayed in tabular or, preferably, graphical form. The object being to highlight the strengths and weaknesses of the wind + interconnectors system in both normal times and times of stress (e.g. continent-wide low winds).

10. Page 5. Add “result in either simultaneous”.

11. Page 5. Typo: ‘from’ and not ‘form’ in “and France moves form”.

12. Page 6. The paragraph before the Conclusion invites the question, “Does not the issue of national infrastructure security require that, wherever possible (e.g. electricity supply), a sovereign nation should NOT be dependent upon any other nation(s) for its energy needs?” Commercial considerations (while valid) are different from security considerations, with the two usually operating in very different circumstances.

While this issue is addressed in the Conclusion it should be discussed first in an earlier section in order for it properly to form part of the Conclusion.

13. Following on from comment 12, to what extent (if any) would the interconnectors be of use in a ‘black start’ situation on the UK Grid (e.g. following collapse of the UK Grid, perhaps resulting from poor control of a large system fed by too many unreliable/non-dispatchable generation sources)? See also comment 14 below.

14. To what extent are the interconnectors a source of voltage and current harmonics ‘pollution’, particularly in times of system stress? This question seems most pertinent in a ‘black start’ scenario where the Grid requires pure fundamental AC sine waves which the interconnectors’ converter stations will try to synthesize from DC.

Reference

1. B.M. Weedy et al., “Electrical Power Systems”, 5th ed., Wiley, 2012, pages 38, 319-320.

——————

David Frith, Former Projects Director in the power generation industry

Dispatchability is probably the key issue here. As long as we don’t have a solution for bulk energy storage, we will continue to need a means of balancing supply and demand.

If interconnectors were truly dispatchable, that would be a great help, but unless other countries would commit to making that true, I think we have to err on the cautious side and assume that the majority of interconnectors may be subject to national priorities, not commercial ones.

We do have some dispatchable storage, eg Dinorwig, but I have seen very little written about pursuing compressed air energy storage (CAES) or liquid air energy storage (LAES). Certainly the former is technically achievable now and I don’t understand why there aren’t adequate incentives provided to make it happen. It is of course dispatchable and scalable. It would also be better for the planet than building out loads of small diesel generators! I haven’t checked into the latter recently, so can’t comment on its present feasibility. However market incentives to enable such technologies should definitely be put in place. Pumped hydro is technically doable, as we use it now, but expensive as it is very capital intensive with along lead time and likely the best places to do it are already in use. Again there should be market incentives to allow it if suitable locations do remain.

In short we should be taking full advantage of alternatives that do exist that make us more self reliant. Interconnectors can be cut!

In practice, any serious attempt to build up electricity infrastructure to the levels envisaged by NG ESO scenarios will still require a significant amount of other dispatchable power plant. This could be provided by thermal (gas and/or hydrogen, waste to energy, biomass to the extent that it is done sustainably) small nuclear (some of which, like Rolls Royce, are I believe dispatchable). All can have a part to play, given the right market incentives, alongside large nuclear base load. However it seems to me that the current emphasis is all against extra generation and more on wind, interconnectors and energy saving. We cannot avoid the elephant in the room of needing extra generation if the NG ESO scenarios are anything like reasonable. Relying on interconnectors just will not cut it.

—————

Julian Spence

The initial paragraph spells it out that “To manage dunkelflaute” and then describes storage technologies that only are applicable for a matter of hours (risibly described as LDES) and so the interconnectors will solve the (many days long) dunkelflaute problem; it might be worth stressing this mismatch of timescales for storage

It might be worth pointing out that, essentially, interconnectors function as a super national grid; and similar issues (stress events) might arise , for example, with the Scotlsnd England power links (eg when Scotland has no nuclear power and there is a dunkelflaute0; this then might form a suitable stress event for testing purposes.

It is right that the ESO mentions storage as related to connectors – as they form buffers to stabilize the flow (and cost) of power. But they give no indication of the required amount and frequency (timescale of storage) . Computer and electronic systems use layers of buffers with different sizes and response time

I am unclear as to who makes a profit or pays for the use of the interconnectors and, importantly, how these payments (and the price of power) may vary (especially during dunkelflaute events) ; this would be useful for those considering resarch into LDES (true LDES, that is, – sufficient buffering of energy for dunkelflaute). Is this information available?

The report describes periods of high and low wind but it is unclear if these are defined in terms of wind or of power generation; for example a dunkelflaute of 10% for 11 days would describe a period of 10 days when the power generated by wind was less than 10% of capability. This is important as wind power is significantly non-linear in relation to wind velocity

The de-rating factor used is based on only one year; is there, thus, a danger of cherry-picking.?So using years, such as 2021 might show a different, and much lower, minimum factor.

—————-

Mark Uffen

Potentially a very large topic, so I understand the desire to focus on the idea that interconnectors are no great saviour in a world where there is insufficient dispatchable capacity to meet demand across the interconnected area. Indeed, in such conditions it becomes a bidding war for who gets the blackout, unless government intervenes to prevent exports. Already we have seen Dublin forbid export on the E-W link, and Norway claiming reduced capacity on North Sea Link on trumped up excuses. Currently there are widespread complaints in Europe about French restrictions on export capacity that have resulted in extreme price differences in recent days. The UK has shown its hand by being prepared to bid almost £10,000/MWh for supply via NEMO, ostensibly to keep the lights on in London while maintaining exports to France which could have been reduced (perhaps at lower cost?) to similar effect.

IFA was the first major GB interconnector (opened in 1986), built to tap the cheap nuclear power from the complex at Gravelines near Dunkerque to which it is directly connected. Other than maintenance, cable breaks (a ship’s anchor caused a several month interruption) and the fire at Sellindge it has tended to operate at high levels of import until the French nuclear fleet started to run into problems. Indeed, in 2022 GB was exporting almost continually on its links to France with extra volumes going via NEMO to Belgium and on BritNed, supplied by running incremental CCGT: since exports via the gas pipelines to Zeebrugge and Balgzand were maximised it was also effectively a way for Europe to be able to stockpile more gas during the energy crisis, as the imported power avoided the need to run CCGT on the Continent. See chart

https://i0.wp.com/wattsupwiththat.com/wp-content/uploads/2023/02/GB-Gen-Price-HQ-1676233783.8236.png

The next interconnector was BritNed, which was built following the cancellation of the Kingsnorth D coal fired power station after protests by Greenpeace led by Zac Goldsmith. The UK HVDC station is on the site that Kingsnorth D would have occupied, while the Dutch end at Maasvlakte is right next door to the MPP3 coal (and later co-fired) power station the Dutch built to feed it. In essence, the UK offshored a coal fired station and paid extra to connect to it while pretending that the import was zero carbon. Google Streetview shows MPP3 with steaming chimney stack on the left, coal stockpile in the centre, and the HVDC converter station on the right in April 2023

https://maps.app.goo.gl/frUzfbzr991vbK6m9

MPP3 did at least help bail us out in the aftermath of the Fukushima crisis, when LNG prices were bid up by Japan, and coal was a cheap form of supply that we maximised ourselves: we would have run Kingsnorth D flat out too if we had it.

Further interconnectors have been built mainly with an eye on attempting to avoid investment in dispatchable capacity in the UK while trying to be “green” and dissembling over nuclear.

National Grid in its role as custodian of Future Energy Scenarios has a vision of the future which requires massive expansion of grid and interconnector capacity – conveniently greatly expanding its asset base and earning potential. The alternative of a low carbon dispatchable grid French style, based on nuclear power, not requiring connection to remote wind and solar (X-links!) and massive interconnection has been excluded from consideration. Even with the separation of the system operator and energy scenario role from the company running the transmission grid and owning 50% of most interconnectors it is likely that the staff will retain the NG mindset. In 2020 OFGEM ran a series of consultations on interconnectors which included a report from AFRY

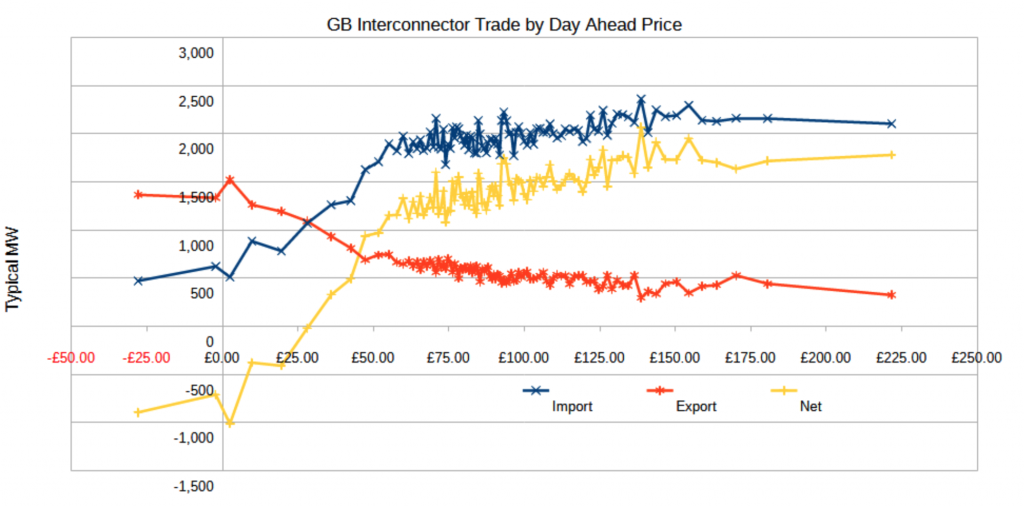

They noted None of the identified interconnectors benefit GB consumers which is perhaps not surprising, given that we have to pay the cost of the interconnectors where we import, on top of whatever is the marginal economic cost of producing an export surplus as a minimum; where we export, with the exception of the 2022 case, and the limited export to Ireland (which tends to share our weather and hence level of renewables output and need to import), the export is at low prices. This chart shows 2023 interconnector trade by Day Ahead price: each point covers a percentile of the time and shows the average import, export and net trade for that percentile.

It is clear that at prices above £50/MWh export is mainly confined to ~500MW to Ireland, while imports average ~2GW. Below £25/MWh GB becomes a net exporter, even at negative prices. These extra exports stem from surplus renewable generation that is subsidised via ROCs or CFDs. Given the way the market operates, the generators with the biggest subsidies get to continue to produce and export, while the generators with the lowest subsidies get curtailed if export markets won’t take the surplus. GB consumers get to subsidise low and negative price exports for the benefit of the export markets.

I made my own contribution to the OFGEM consultation, available here:

https://www.ofgem.gov.uk/sites/default/files/2021-12/F2S%20Response%20%281%29.pdf

It contains a number of additional charts demonstrating the impact of interconnectors, looking at how the wind doesn’t blow almost everywhere at times, and almost everywhere at others, comments on the FES, the conflict between storage and interconnection trying to solve the problems of large scale intermittency, etc.

I note that Greenlink will give Ireland access to Pembroke CCGT, while Lionlink will give the Dutch access to Sizewell (B and C) nuclear power, in both cases diverting power from local inland networks. We still seem to be very keen to subsidise the EU.

—————-

National Grid UK

Thank-you for the opportunity to respond to the analysis presented by consultants Watt-Logic in the article dated 24th April, “Interconnectors and their impact on the GB power market”. National Grid would like to offer the following perspectives.

1) GB-connected interconnectors have overwhelmingly operated in the GB-import direction historically in line with market prices, offsetting otherwise higher CO2 emissions and contributing significantly to GB security of supply.

2) The modelling approach using Transmission System Demand overstates the occurrence of IC exports during high demand, leading to misleading results. This is because this published value includes interconnector exports as part of GB demand, using this data unadjusted creates a feedback loop that can skew the output.

3) Focusing on demand alone is incorrect, a more complete analysis would reflect the supply versus demand balance – represented by the de-rated margin. This would show that interconnectors operate in the GB-import direction almost exclusively when system conditions are tight.

4) The GB Electricity System Operator has mechanisms in place to influence flows over the interconnectors that can be used in periods of system stress, allowing them to reverse the flow direction, if necessary, to manage system constraints in a cost-effective way.

5) GB’s interconnector portfolio connects us to markets with a range of different technologies in their fuel-mix and patterns in their demand, these differences allow the interconnectors to deliver mutual benefits and improve security of supply.

6) The interconnector assets that connect GB to our European neighbours bring significantbenefits to the UK and the interconnected market in terms of system security, consumer costs and reducing carbon emissions.

These points are explored in more detail below.

1) Interconnector Flows in Context

The analysis states that GB exported in 23% of hours with the top 5% of demand for 2022 and 2023.However, this coincides with a period of low French nuclear availability (as mentioned in the paper) which triggered significant exports from GB to FR as illustrated in the graph below. This demonstrates the vital flexibility that ICs provide to consolidate security of supply across both ends. Moreover, the time difference between GB and EU enables the assets to switch flows during peak load times to accommodate the needs of each country whilst reducing the cost to the end consumer.

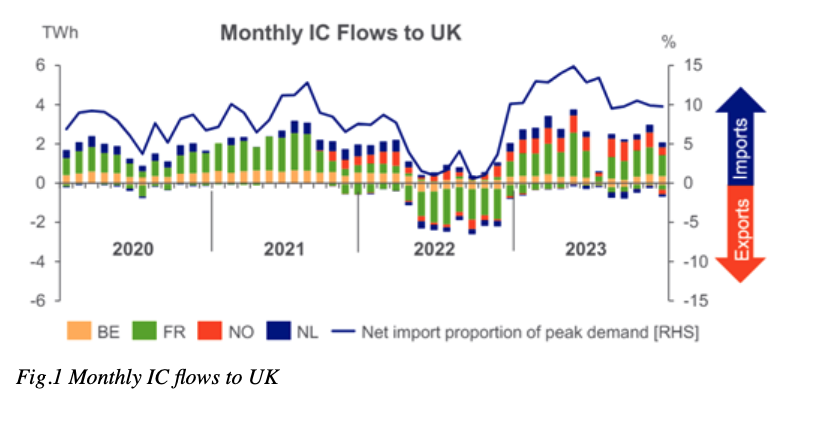

Furthermore, our analysis suggests that the percentage of GB demand covered by IC imports is subject to an upward trend and peaked at circa 15% in 2023. See Fig.1 below.

Fig.1 Monthly IC flows to UK

GB-connected interconnectors have overwhelmingly operated in the GB-import direction historically in line with market prices, offsetting otherwise higher CO2 emissions and contributing significantly to GB security of supply.

2) Modelling Approach using GB Demand

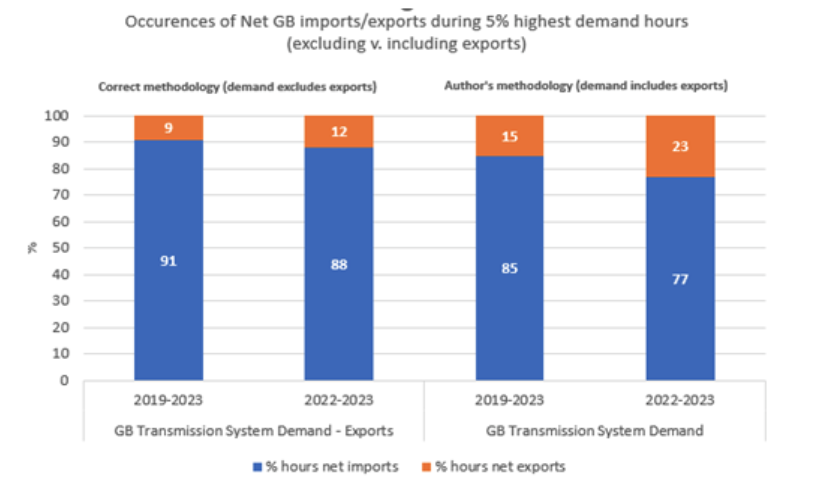

The author states that “Across the two years, Britain exported in 23% of the top 5% of hours with the highest demand”. After cross-checking and recalculating this figure using ESO demand data, we believe the author uses GB “Transmission system demand” to identify periods of highest demand. However, the GB transmission system demand includes GB exports to connected markets. This leads to misleading conclusions and we performed our own calculations to compare with the author’s approach. See Fig.2 below.

Fig.2 Net GB imports/exports during 5% highest demand hours (excluding v. including exports)

By subtracting exports from the GB Transmission System demand dataset, our analysis indicates that the values presented in the paper are overstated. In fact, GB IC exports during the period in question (2022-2023) stand at 12%, much lower than 23% cited by the author.

If we extend the examined period to 2019-2023, our calculations suggest that 91% of the time GB ICs were importing to the country during the top 5% demand hours across the 2019-2023 horizon. This demonstrates that the large majority of the time GB ICs import to GB when system demand is at elevated levels.

The modelling approach using Transmission System Demand overstates the occurrence of IC exports during high demand, leading to misleading results.

3) Alternative Methodology using De-Rated Margins

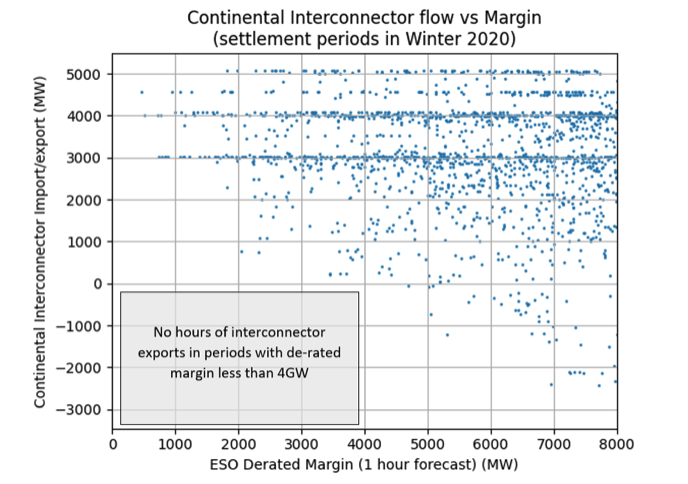

As generation availability can be high at the same time as demand is high, GB system demand is not a good indicator of system security. De-rated margin is a better indicator of surplus or shortages on the GB electricity system. ESO publish half-hourly data for de-rated margin (forecast one hour in advance). The ESO also publish a loss of load probability, which is directly dependent on the de-rated margin.

In Winter 2020, there were 10 settlement periods with derated margin below 1GW. Within all ten periods, the interconnectors linking GB to continental Europe that were operational at that time (IFA, IFA2, Nemo Link and Britned) were strongly importing at 3-5GW. In fact, referring to the scatter plot for Winter 2020 comparing interconnector flows with de-rated margins (see Fig.3), the suite of continental interconnectors never exported for any settlement period with derated margin below 4.5GW. The suite of all GB interconnectors (including those connecting GB to the SEM market) did not export for any settlement period with derated margin below 3GW. This is far above the threshold of what would be considered a tight margin.

Fig.3 Continental Interconnector flow vs Margin in Winter 2020

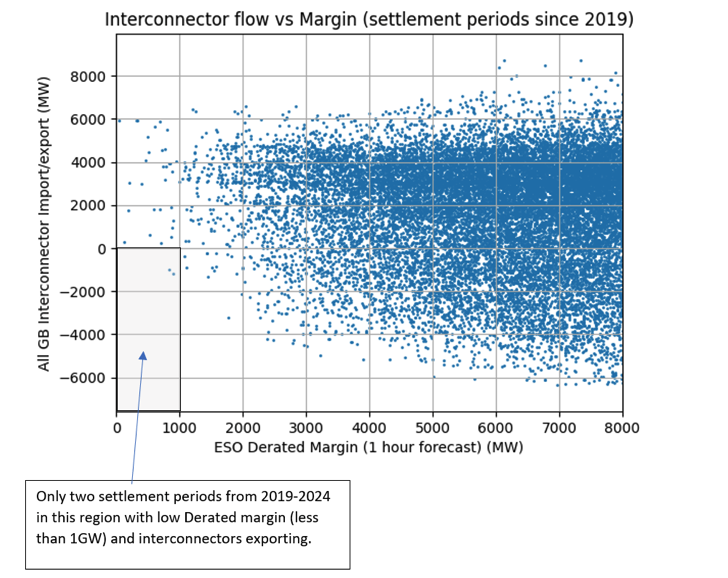

The same pattern also holds true over a longer sample period, with just 2 settlement periods witnessing net exports of the interconnectors during periods with a margin of 1GW or less since 2019. Se3 Fig.4. below.

Fig.4 Interconnector flow vs Margin since 2019

Focusing on demand alone is incorrect, a more complete analysis would reflect the supply versus demand balance – represented by the de-rated margin. This would show that interconnectors operate in the GB-import direction almost exclusively when system conditions are tight.

4) ESO influence on Interconnector Flows

The paper states that “there are no mechanisms to force imports if the capacity has been sold to market participants for the purposes of exporting”. This does not reflect the reality as the ESO can intervene and ask traders to reverse the direction of the flows if it is needed. Various SO-SO tools are also available that all the respective system operators to request support from their counterpart to provide. These allow actions to be taken to manage system issuesprior to any demand disconnection which would be the last resort for the ESO.

In addition, the paper does not investigate the impact of commodity prices in influencing the direction of the flows. Interconnector flow schedules are a function of nominations by market participants which are determined by a freely functioning market. Factors such as commodity price movements, renewable output and varying demand patterns are all factors considered by market players when determining a cross-border flow. There is also a disconnection between UK and EU ETS prices which makes UK thermal generation more economic compared to EU. Interconnector assets serve their connected markets best when they are allowed to respond to market conditions.

The GB Electricity System Operator has mechanisms in place to influence flows over the interconnectors that can be used in periods of system stress, allowing them to reverse the flow direction, if necessary, to manage system constraints in a cost-effective way.

5) Correlation in weather patterns with interconnected markets

The author mentions that “proximity tends to result in high weather correlation”. Although there is a correlation in weather patterns with our partner countries, many of them have a different mix of energy sources. For example, France has greater reliance on solar and nuclear power and Norway has greater reliance on hydroelectric power. This is unlikely to change in the medium term. Interconnection with these countries thereby allows GB to balance our energy portfolio by incorporating more of these diverse sources into our energy mix. It is well known that diversification reduces risk, as there are more generating options that could be available in times of system stress.

GB’s interconnector portfolio connects us to markets with a range of different technologies in their fuel-mix and patterns in their demand, these differences allow the interconnectors to deliver mutual benefits and improve security of supply.

6) Mutual benefits on interconnectors

In summary, it should be recognised that the interconnector assets that connect GB to our European neighbours bring significant benefits to the UK and the connected market in terms of system security, consumer costs and reducing carbon emissions.